I changed the title based on this suburb explanation of where we’re at in early 2025. The Wile E. Coyote Recession

Energy is money and money is distributed evenly throughout a nation’s population. Therefore, petro-inequality is impossible in the United States. That’s a joke. Fortunately, building inequality was masked by a net-increase in energy use, which benefited most Americans.

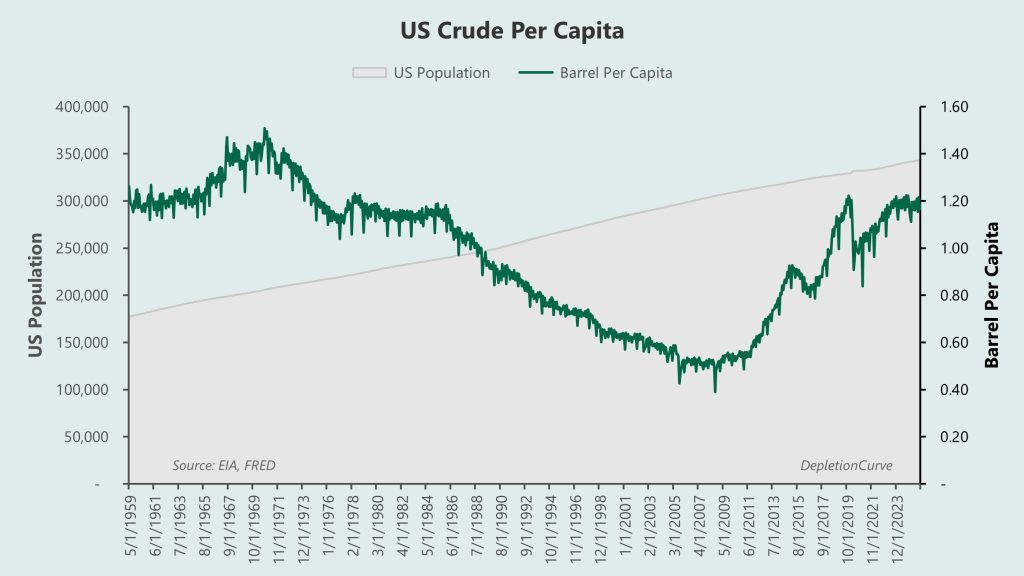

The chart above charts the amount of U.S. oil per person since 1959. We can see Hubbert’s peak in the 1970s and then fracking coming to the rescue after 2008.

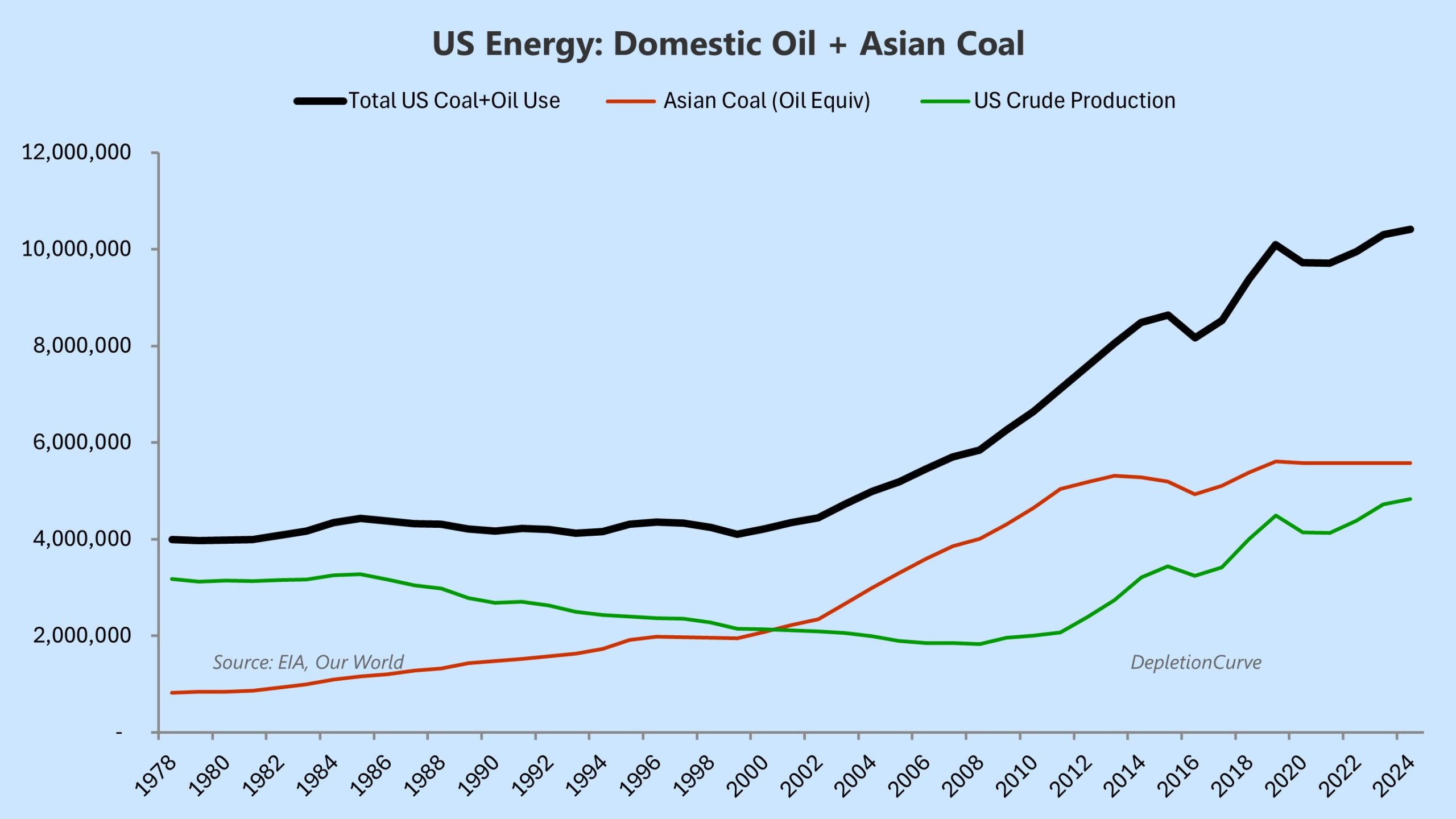

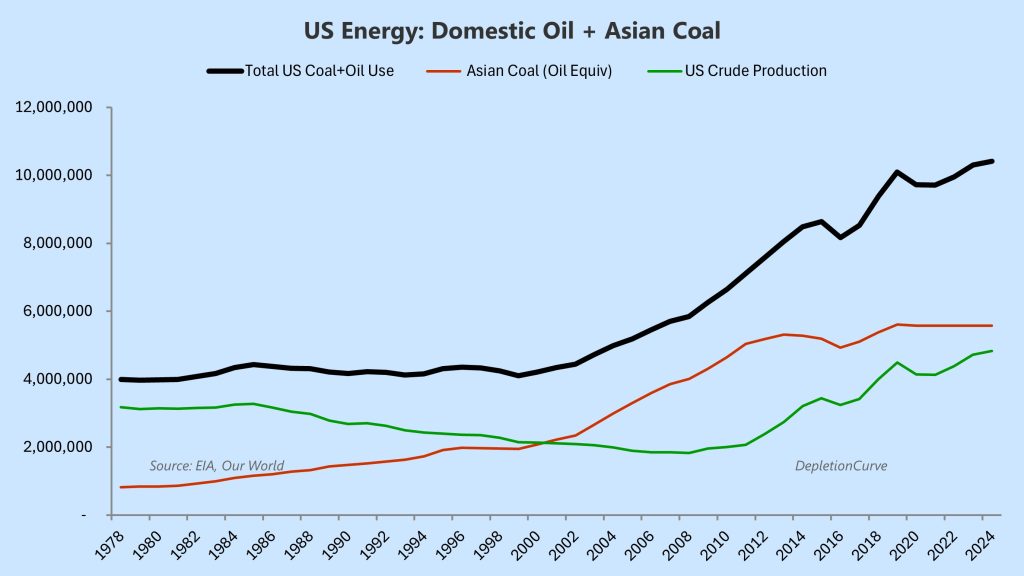

Why didn’t the U.S. go into a depression between 1980 and 2010? A period where the U.S. had increasingly LESS fossil fuels to burn? The answer is that China made up the shortfall–and THEN SOME! It burned coal and lowered the cost of economic consumption for the U.S.

The green line is U.S. oil production. Although it went down from 1980 to 2010, coal burning in China increases and a faster rate. If we combine the two, the black line, we can see from a net-consumption basis the U.S. grew dramatically in that time period.

A couple of observations. From 2008 until 2015 both U.S. oil production and Chinese coal burning accelerated. This can explain the explosion of asset values until recently. However, Chinese energy flatlined around 2013 which may explain the discontent that lead to Trump’s 2016 election

Today, all world energy has stagnated (and declining in many places). Energy stagnation does much to explain, to me, the current political crisis.

Anyway, without China it’s quite possible the U.S. would have experienced poor growth, if not a long recession, from 1980 to 2010.

This is what we all know; we outsourced our manufacturing to China. In return we experienced net-economic growth. A win-win for both.

Then we enjoyed a bonus round–fracking, which boosted U.S. production to pre-Hubbert peak levels.

So why are we deporting immigrants and firing federal workers? Looking at the chart, we should be enjoying peak oil again–the same peak we reached in the 1970s.

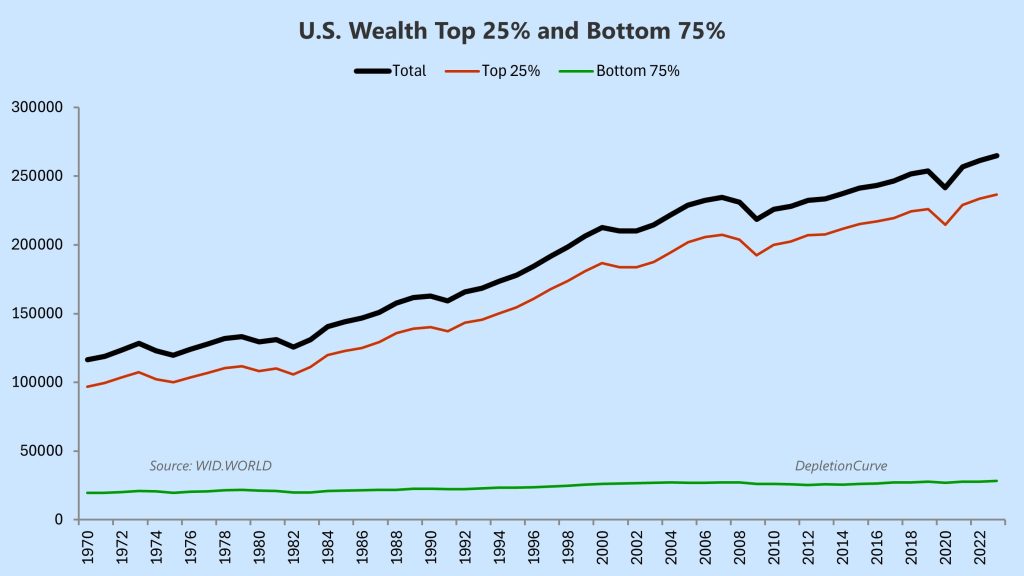

My theory is that as fossil fuels became more expensive to mine the extra costs were indirectly extracted from the less wealthy. The wealthy were able to do this because they control banking and regulations. AND, most importantly, they had first dibs on Chinese goods. There was no ability of the bottom whatever to “unionize” against China.

A glaring example of this is EV credits. The components are made in China and wealthy car-buyers get a rebate to buy them. In short, poor people–which isn’t intuitive–benefit less from Chinese cheap goods as time goes on.

We can view this in many wealth comparison datasets. Here is net-income for the top U.S. 25% and bottom 75%

Housing is another bellwether. In 2000: 30-35% could afford homes at 6x income; In 2020: 15-20%.

The bottom has fallen out of the boat. Another analogy like Wile E. Coyote. Panic hasn’t set in yet.