We’re once again near “peak” oil (1971, 2008, 2018…?). Even if not, oil prices must rise for production to continue, let alone grow. It takes fossil fuels to mine fossil fuel–today more than ever.

Meanwhile, Israel has gone into overdrive, pushing the U.S. to bomb Iran. The vast majority of military experts do not believe it would be successful. Nevertheless, the growing political forces of ignorance have overwhelmed military analysts. Other military mis-adventures have also grown more likely.

Many believe “renewables” are a substitute for fossil fuels. That will never be for the military. No military can function without diesel, gasoline and jet-fuel. Therefore, any war involving the U.S. will push the U.S. to once again focus on oil, driving its price higher.

In the Spring of 2021 I put all my meager savings into GLD. In 2022 I added GDX. My thesis was that too much money was printed to deal with the pandemic. I told myself it it could take five years for gold to reprice. I ended up waiting three years. Last September I actually tried to sell into cash, fearing another 9/11. Fortunately, because I rarely use Schwab’s app I sold only one share. Luck was on my side. I only realized my mistake after gold kept running up and my brother pushed me into checking my account.

My position has pretty much doubled so I believe my thesis is complete (thanks to luck) and any further rise of gold would be psychological.

That’s the backstory. I have gold, when do I sell and buy oil? First, I want to get an idea what energy stocks are worth today. Here’s Exxon.

My read of the chart is that it’s possible for oil to go down to $40, an inflation-adjusted low, with today’s downwards pressure. I also believe there’s no downside-pressure for gold on the horizon so m first thought is to let gold ride and go into oil when the “event” happens.

But what if the spike in oil, should war start, provide most of the gains. I asked Claud.ai and ChatGPT.

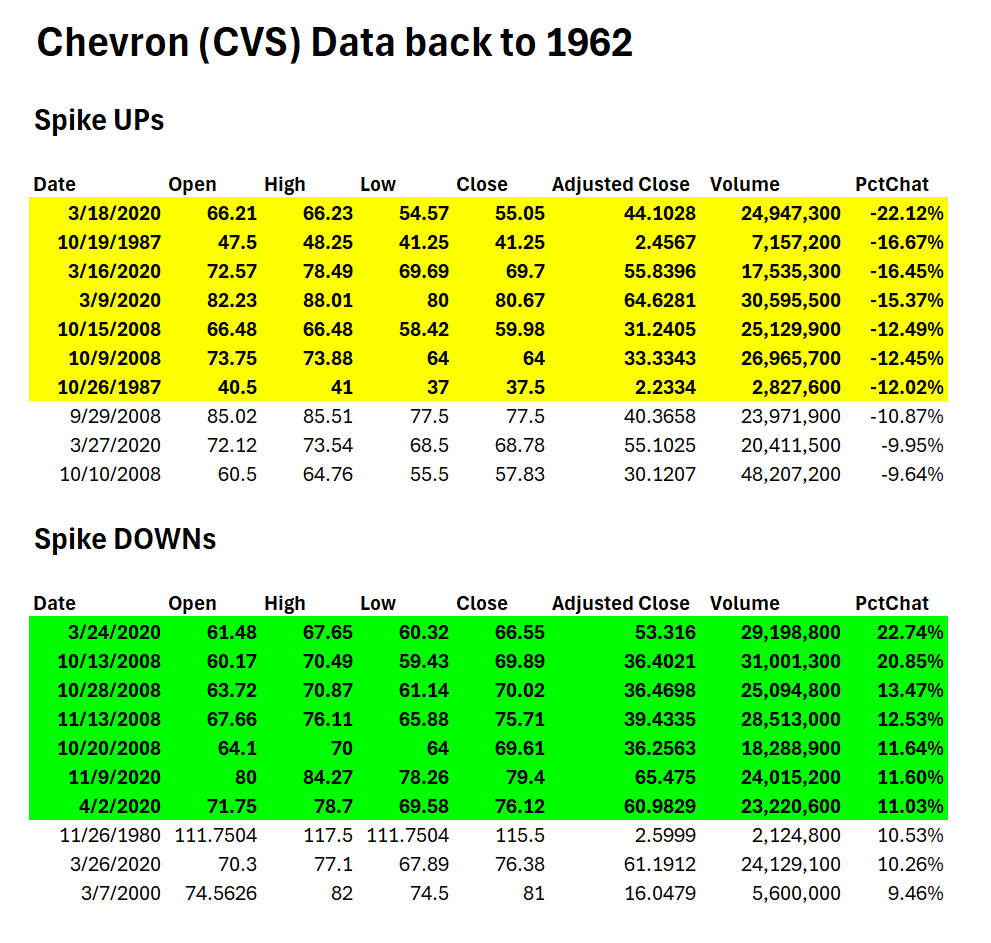

I love AI, but it’s no use here. So I had to do my own analysis. Here are the price spikes for CVX going back to 1962

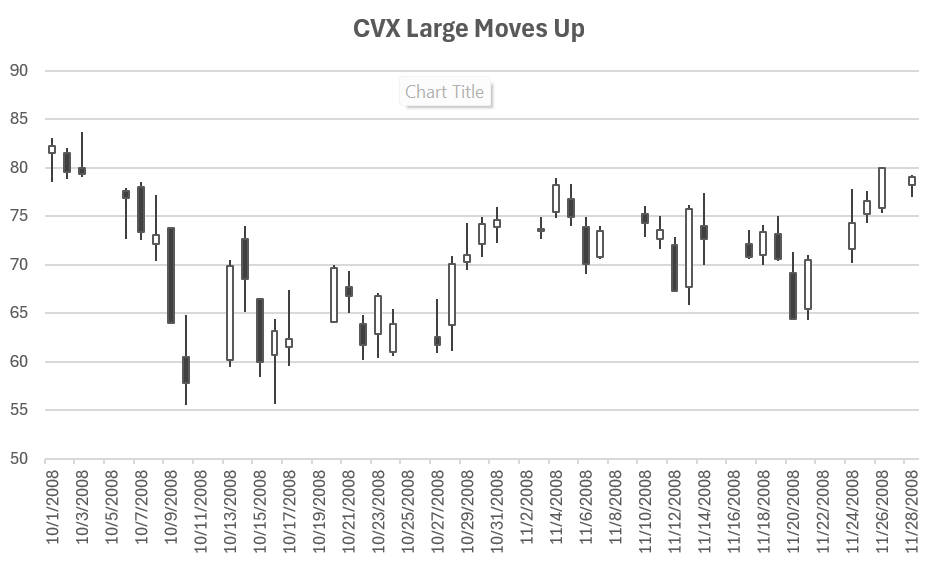

XOMs were similar. Next I looked at period when there was high price volatility. What I noticed is the biggest upward swings were during price volatility downs. That is, the large price rises weren’t part of rising price trends! They were adjustments. (please note, in much of what I say, I might not have looked at enough data or in the right way or both).

For now, I don’t see how I need to be in oil before an event. I will have plenty of time to buy in afterwards.

I also have to remember that for most people oil is not on their radar. That’s part of my thesis. So if the U.S. bombed Iran tomorrow it would take weeks or months for investors to get up to speed on the simple fact–the U.S. can’t go to battle without oil. Or do a lot besides.

Therefore, I have decided, based on today’s analysis, that I will stay in gold until something happens then start moving into oil. Any thoughts appreciated!